🧵 Why $CYPR ( @Cypher_HQ_ ) is top tier quality exposure to the Neobank Meta:

Seeing funny comments on the TL about "stop chasing betas" and just hold $AVICI. NGMI mentality - the next trade is always the most important and if you're bullish on $AVICI you should be bullish on the entire meta as that's what will keep propelling the GOAT of this meta.

Many good threads out there on $CYPR, I don't want to regurgitate but I do think its nice to have a thread that compiles/ gives you bigger picture so you can find your own conviction bid

TLDR:

1/ $CPYR is one of the few "top 10 cards" (by deposits+spends) that has a token making it ez picking.

2/ Comps table (Doing 2.5x vol monthly than marketcap ((including more vol than $AVICI) )

3/ Catalysts: buybacks + x402 integration

4/ Investors are top tier

6/ Exchange listings and liquidity are coming (with such top tier investors/ connections wouldn't be a surprise to see T1 listings)

1/ There aren't many liquid opportunities in tokens to isolate crypto card exposure right now. Huge advantage for ez pickings.

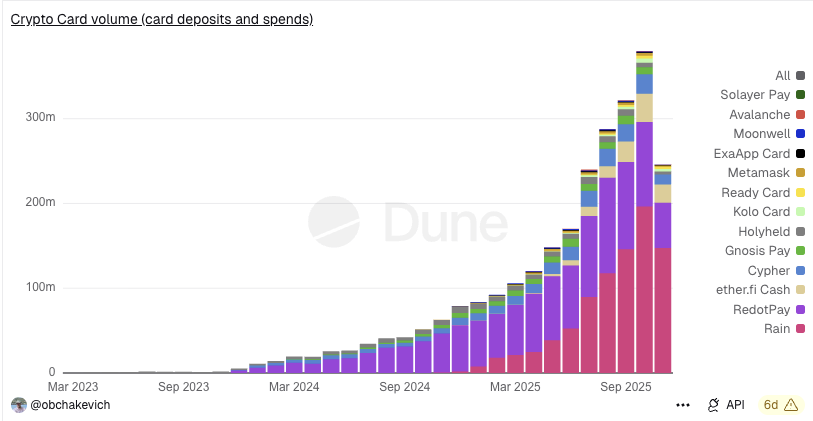

Lets take a look at the top 10 crypto cards on @DuneAnaIytics (courtesy of

@obchakevich)

***This dashboard combines both deposits + spends together***

1/ Only 4 of the TOP 10 Cards by volume have tokens ( $CYPR, $ETHFI, $AVICI, $GNO)

2/ Do you see the trade in the table?

$CYPR is an extreme outlier – volume is 2.4× the entire market cap in just one month ( previous months have also shown impressive traction)

This is the strongest reason why im extremely bullish - This isn't speculation which is so often what we price in crypto, but what's happening right now.

CYPR is completely undervalued on fundamentals and it's a very easy metric for degens to understand why which also greatly helps.

6/ Exchange listings and liquidity are coming (with such top tier investors/ connections wouldn't be a surprise to see T1 listings)

Lots in the pipeline to be excited about for

2.032

14

Il contenuto di questa pagina è fornito da terze parti. Salvo diversa indicazione, OKX non è l'autore degli articoli citati e non rivendica alcun copyright sui materiali. Il contenuto è fornito solo a scopo informativo e non rappresenta le opinioni di OKX. Non intende essere un'approvazione di alcun tipo e non deve essere considerato un consiglio di investimento o una sollecitazione all'acquisto o alla vendita di asset digitali. Nella misura in cui l'IA generativa viene utilizzata per fornire riepiloghi o altre informazioni, tale contenuto generato dall'IA potrebbe essere impreciso o incoerente. Leggi l'articolo collegato per ulteriori dettagli e informazioni. OKX non è responsabile per i contenuti ospitati su siti di terze parti. Gli holding di asset digitali, tra cui stablecoin e NFT, comportano un elevato grado di rischio e possono fluttuare notevolmente. Dovresti valutare attentamente se effettuare il trading o detenere asset digitali è adatto a te alla luce della tua situazione finanziaria.