Just listened to the @RaoulGMI and @santiagoroel podcast, and the case for TEV being the right metric (since the market seems to treat it that way currently) is that trust and liquidity are network effects built up over time. At the moment, it definitely doesn’t look like the base layer is capturing that value, because it makes almost no difference whether I send or swap $1 USDC or $1 billion USDC. But it seems the market still prices the probability of capturing that fairly highly (priced to perfection).

So the question for me is: how could the base layer ever actually capture that value, and what would the playbook for that look like?

To capture that value, you’d probably need some way of incorporating price oracles into consensus or otherwise creating an economic mechanism to charge fees on a USD-denominated basis on a protocol level.

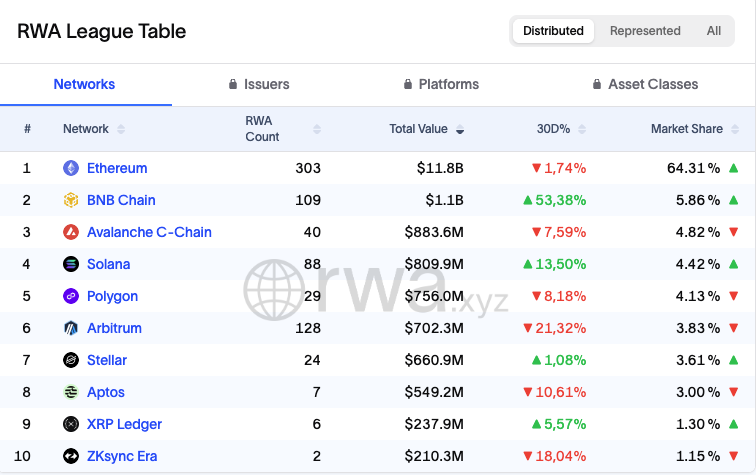

Obviously this would sound outrageous to an ETH maxi, but it does feel like a pricing problem. The problem with something like this, I’d say, is that for RWAs it doesn’t really matter where they’re issued or where they circulate, because they’re always their own L1. Regardless of that and actually beeing more expensive most issue on Ethereum.

Usually I’m in the camp that L1 premiums are increasingly challenged by UX improvements, and that those who control distribution can effectively control the stack. Nonetheless, I appreciated that slightly heated conversation and think it was highly productive to bring those two camps together. It got me thinking again about what the other side of this might look like and challenge my bias.

I don't think you can charge L2 taxes btw since you gave them their own state and they will switch to Celestia or something else while the user not even realising

4,63 mil

6

El contenido de esta página lo proporcionan terceros. A menos que se indique lo contrario, OKX no es el autor de los artículos citados y no reclama ningún derecho de autor sobre los materiales. El contenido se proporciona únicamente con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo vinculado para obtener más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. El holding de activos digitales, incluyendo stablecoins y NFT, implican un alto grado de riesgo y pueden fluctuar en gran medida. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti a la luz de tu situación financiera.