Demand for market-neutral Bitcoin strategies has surged sharply, and the activity surrounding @TheTNetwork and @yieldbasis illustrates this shift with unusual clarity. Within an astonishingly short window, each BTC vault tBTC included amassed $50M in deposits, signaling how aggressively traders are seeking ways to preserve full BTC exposure while simultaneously harvesting yield from pricing imbalances across markets.

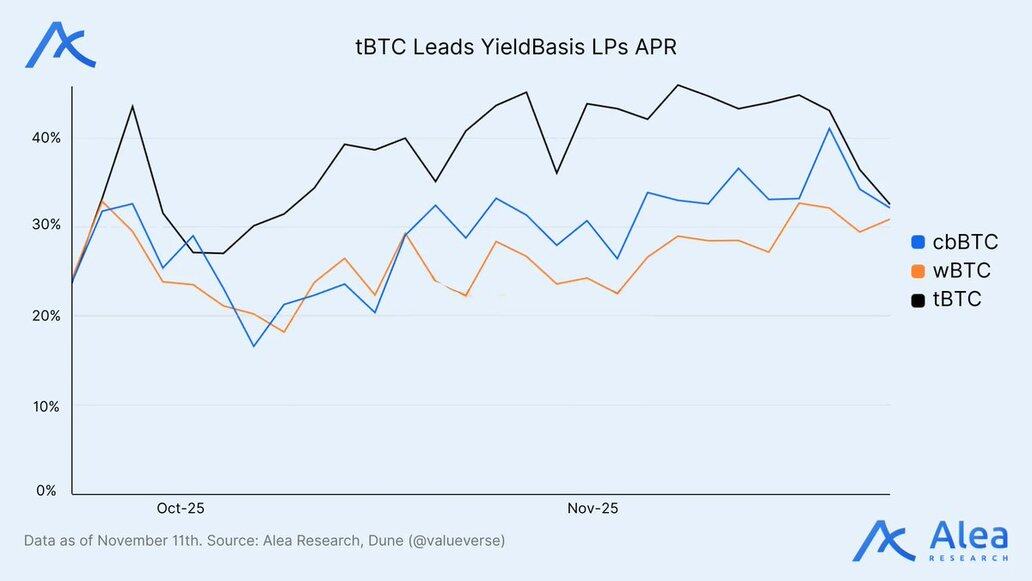

Rather than pursuing directional bets, participants are leaning into approaches that neutralize price swings yet exploit the persistent gaps between funding rates, a pattern that has become increasingly attractive as volatility compresses. In this landscape, tBTC has started to emerge as the collateral of choice, not only because of its trust-minimized structure but also due to the consistency it brings when deploying capital into onchain, delta-neutral frameworks.

As more users migrate from speculative positioning toward structured yield generation, the combination of transparent vault mechanics and permissionless collateral forms a foundation that traders can scale without sacrificing security or liquidity. What we’re seeing now is not just a spike in deposits, but the early stages of a broader movement toward systematic BTC yield strategies built entirely onchain.

For those wanting a deeper breakdown of how basis-style positioning works within this ecosystem, the mechanics behind the strategy and why tBTC strengthens it are explored in detail in the @TheTNetwork ’s write-up.

@Galxe #Galxe #STARBOARD

Each @yieldbasis BTC vault filled $50M, including tBTC within an hour, underscoring the demand for delta-neutral yield strategies that maintain full BTC exposure while capturing funding differentials.

tBTC is increasingly becoming the preferred collateral for executing these onchain market-neutral positions.

Read more about Basis Trading Strategy via:

1.5K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.