TT.Z

TT.Z

2Following

0Followers

Seventeen years, from the Chicago Exchange's public outcry pit to the algorithmic jungle of Shanghai's quantitative dark pool, my trading logic was born from the panic fluctuations of the 2008 crash and matured from the reverse sniping in the liquidity trap in 2020. He is good at capturing the shadow of black swans with cross-market entropy increase strategies, and is accustomed to using option matrices to construct asymmetric risk-returns when the VIX index is torn.

My eyes are fixed on the China-US interest rate differential curve, the rise in rare earth spots, and the migration of Bitcoin mining machine computing power - these seemingly unrelated variables will condense into a single probability cloud in my model. Last year, the annualized Sharpe ratio under the Contango structure of natural gas futures reached 4.7, and in the first quarter of this year, the convertible bond + stock index futures hedging combination of Hong Kong undervalued brokerages captured 97 basis points of alpha in 18 trading days.

I don't believe in the golden cross of any technical indicators, I only believe in the migration of institutional positions in the central clearing data...

Show original

Overview

Futures trades

Spot trades

Bot trades

Stats

Total PnL%+1.66%

Total PnL+$12.68

Assets$776.47

Days active33

Max drawdown-36.53%

Win rate

0.00%Profit/loss ratio

--Net transfer$761.40

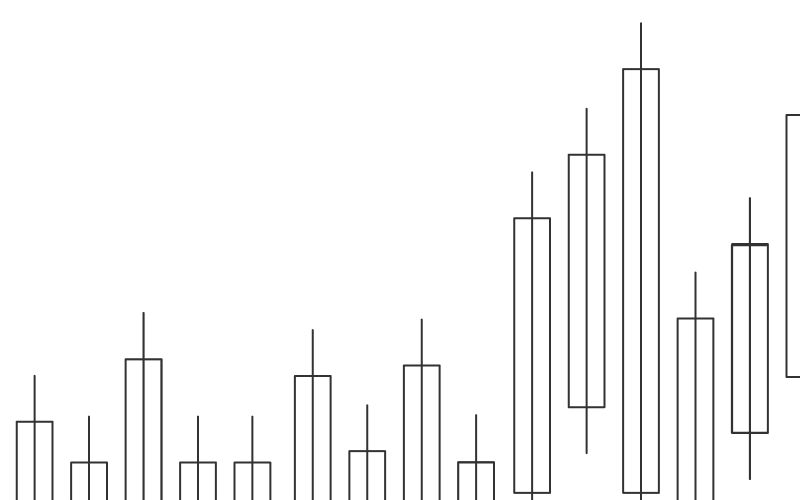

PnL%

PnL

Assets

--

Positions (0)

Assets

Latest records

Open positions

History

Open positions